Report sees opportunities for nuclear supply chain

23 September 2020

The 2020s are likely to be a time of uncertainty for global energy systems with the growing recognition that business-as-usual is unsustainable and represents a threat to humanity, but the global transition to low-carbon energy and the post-COVID recovery will be a time of opportunity for the nuclear energy sector and its supply chain, according to the 2020 edition of a World Nuclear Association report that analyses the economic value of the nuclear power industry. The report is the work of the Association's Supply Chain working group, which is chaired by Laurent-Olivier Coudeyre of EDF.

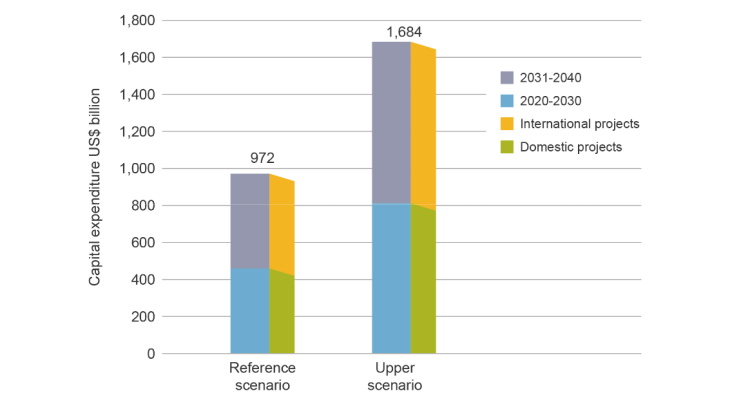

Capital expenditure on nuclear new build could reach USD1.68 trillion (Image: World Nuclear Association)

Capital expenditure on nuclear new build could reach USD1.68 trillion (Image: World Nuclear Association)

Launched today at an online event hosted by the London-based organisation, The World Nuclear Supply Chain: Outlook 2040 provides a market-oriented review of the opportunities and challenges for nuclear power plants and their supply chain, including scenarios for the evolution of nuclear energy over the next two decades.

It presents information on nearly 300 major independent suppliers of nuclear grade structures, systems, components and services, and offers an up-to-date picture of ongoing and planned nuclear power plant construction, major refurbishment, decommissioning and waste management projects.

"Nuclear power is a vital component of future energy plans," World Nuclear Association Director General Agneta Rising said ahead of the launch of the report, which she said makes clear the potential scale of investment needed. "This investment will deliver clean electricity supplies, put billions into local economies and generate hundreds of thousands of jobs."

Launching the report today, Greg Kaser, the working group's staff director, said the report aims to map the supply chain, but also to explain trends in the industry.

"We are in uncertain times. COVID-19 has changed lives around the world, but we also have climate change challenges ahead that we need to address," Kaser said.

In its biennial Fuel Report, World Nuclear Association presents lower, reference and upper scenarios covering a range of possibilities for nuclear power. These scenarios project "equally plausible" futures, Kaser said. The nearer term - the 2020s - is more foreseeable than the 2030s and beyond, but with the current COVID crisis, and climate change, the 2030s could be a time of change, he said. "We could see a switch from one of those pathways … If we just stay with nuclear energy producing [at its current levels] we're not going to be solving the climate challenge."

At the end of 2019, there were 442 operable commercial nuclear power reactors around the world, with 50 under construction and specific plans for a further 109 reactors. Worldwide, nuclear power generates sales revenues of around USD300 billion per year for utilities, the report finds. Under the reference scenario, revenues from operating nuclear plants are expected to grow at 2% per year over the next two decades, reaching some USD460 billion by 2040, with 68% of growth occurring in emerging industrial economies, including China.

Nuclear new build in the period to 2040 will need cumulative capital expenditure of USD972 billion under the reference scenario, and USD1.68 trillion under its upper scenario. Ongoing new construction is valued at about USD220 billion worldwide, of which some USD6-10 billion per year is international procurement for goods and services. This is between one-fifth and one-quarter of the total value of all projects, the Association said.

In addition, work related to the long-term operation of existing nuclear power plant could amount to USD50-100 billion per year - with around USD4 billion per year of international procurement. Decommissioning work on projects requiring immediate dismantling by 2040 could be worth a total of almost USD150 billion.

Researched and written by World Nuclear News