Severstal makes overtures to Berkeley

Monday, 1 November 2010

Russian steel and mining company OAO Severstal has approached Berkeley Resources in a move that may see it make a takeover bid for the company which is working to restart uranium production in Spain. According to Berkeley, it is currently in discussions with the Russian company which has indicated that it will consider making a conditional all-cash proposal for all Berkeley's outstanding shares subject to satisfactory completion of financial, technical and legal due diligence. Mining is scheduled to commence at the Salamanca uranium project by late 2012, but in light of the "considerable financing requirements" for the project, Berkeley points out "it is likely that the terms offered by Severstal are more appealing than those currently available via project or equity financing." The two have already entered into a subscription rights deal giving Severstal the right to acquire 9.1% of Berkeley. Discussions with other interested parties including the Korea Electric Power Corporation (Kepco), with whom Berkeley signed a non-binding memorandum of understanding on development investment and offtake rights earlier this year, will be put on hold until either Severstal decides not to proceed with a takeover bid or the subscription rights deal expires on 10 December 2010.

Russian steel and mining company OAO Severstal has approached Berkeley Resources in a move that may see it make a takeover bid for the company which is working to restart uranium production in Spain. According to Berkeley, it is currently in discussions with the Russian company which has indicated that it will consider making a conditional all-cash proposal for all Berkeley's outstanding shares subject to satisfactory completion of financial, technical and legal due diligence. Mining is scheduled to commence at the Salamanca uranium project by late 2012, but in light of the "considerable financing requirements" for the project, Berkeley points out "it is likely that the terms offered by Severstal are more appealing than those currently available via project or equity financing." The two have already entered into a subscription rights deal giving Severstal the right to acquire 9.1% of Berkeley. Discussions with other interested parties including the Korea Electric Power Corporation (Kepco), with whom Berkeley signed a non-binding memorandum of understanding on development investment and offtake rights earlier this year, will be put on hold until either Severstal decides not to proceed with a takeover bid or the subscription rights deal expires on 10 December 2010.

Most Read

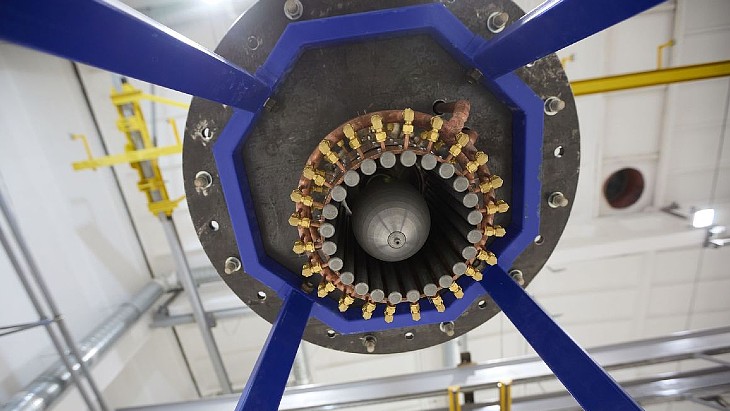

Mars in 30 days? Russia unveils prototype of plasma rocket engine

Friday, 7 February 2025

Nuclear 'a great field for students or people with trades to go into'

Wednesday, 25 September 2024

Argentina ramping up radioisotope production

Tuesday, 22 October 2024

The fluorescent mosquitoes helping to tackle diseases

Monday, 11 November 2024

Podcasts & Features

Viewpoint: Strategic coalitions in nuclear business

Podcasts & Features Tuesday, 8 July 2025

Podcast: The World Bank ends ban on nuclear energy funding

Podcasts & Features Saturday, 28 June 2025

Related Links

Related Stories

..._58412.jpg)