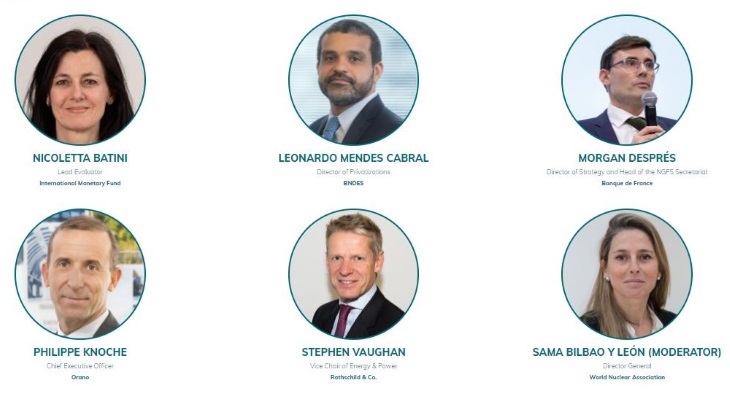

Knoche, who is also the current chairman of World Nuclear Association, said this lack of consensus on environmental, social and governance (ESG) frameworks was out of sync with the recommendations of the Independent Panel on Climate Change and of the International Energy Agency (IEA).

Regarding the EU taxonomy on sustainable finance, he said: "We are facing the risk of a non-technology-neutral taxonomy, or ESG classification, being put forward, which would be a total contradiction of the aim of citizens and governmental institutions to fight climate change. If we go to the experts on climate, the Independent Panel on Climate Change, the vast majority of their scenarios to meet the Paris Agreement targets require all low-carbon technologies to be mobilised. It's the same with the International Energy Agency."

Referring to other panellists on the webinar, he added: "And we've just heard a major institution, the IMF, and the NGFS, talk about the need to have all low-carbon technologies, including nuclear, to meet the scenarios and the targets. The clear answer is, and as Fatih Birol, the head of the IEA, put it: We can't afford the luxury of excluding one low-carbon technology, be it nuclear or another, from our scenarios because if we do, then we will fail.

"We will fail because finance is a major link between the ambition of meeting the Paris Agreement and the projects in the energy industry, which is capital intensive. Fossil, renewables, and nuclear, all these projects need a lot of capital, and the link between the ambition and a project is finance."

The conference was moderated by Sama Bilbao y Léon, director general of World Nuclear Association, who asked Knoche about the role of electricity market structures in attracting and enabling investment in nuclear projects.

Knoche reiterated the point made during the webinar by Nicoletta Batini, lead evaluator in the IMF's Independent Evaluation Office, that there needs to be a value placed on carbon emissions. A market-based tool, such as a carbon tax, would help ensure existing low-carbon technologies, such as nuclear, were not overlooked by investors, Knoche said. There needs to be "market oriented, political, multi-partisan visibility", he said, and not only politically but also in terms of regulation.

Referring to the remark US Climate Envoy John Kerry made at the World Economic Forum in January, that the climate crisis is "a war we cannot afford to lose", Knoche said any chance of victory requires "everybody to be aligned".

"Energy systems are complex, but the good thing is that once everyone is aligned they are so powerful," Knoche said. "It's problematic when there is no coherence between the ambition to fight climate change and either the regulations and the value of carbon, or the way you allocate risks and investments, be they regulated asset based or direct."

He stressed that 'classification' doesn't just concern taxonomies, since the European Commission has announced it will not finance R&D projects that are not taxonomy compatible. "So you have this vicious circle," he said.