The agreement was concluded as part of the US Export-Import Bank's (US EXIM's) Engineering Multiplier Program (EMP), which aims to finance preparatory and engineering works for projects carried out with the participation of US companies. The loan will increase Polskie Elektrownie Jądrowe's (PEJ's) liquidity by enabling it to refinance part of the works previously performed by the Westinghouse-Bechtel Consortium under an Engineering Development Agreement.

The Engineering Multiplier Program covers financing for key works carried out prior to the commencement of the construction phase, including feasibility analyses and selected engineering and environmental services. It is intended for projects with high potential for generating further export orders from the US and supports the preparation of projects for subsequent stages of financing.

Negotiations with US EXIM were conducted with the support of specialised law firms. The agreement complies with OECD guidelines and is secured by PEJ assets. PEJ said the agreement in its current form fully covers the needs and risks of the nuclear project. Bank Pekao SA, acting as the facility agent, is also a party to the agreement.

"We are consistently moving from letters of intent to first agreements," said Marek Woszczyk, President of the Management Board of PEJ. "The agreement we signed with US EXIM is another example demonstrating the credibility of the Polish nuclear project. The formal inclusion of the US export credit agency in the project also opens the way for us to sign further financing agreements with international institutions."

"This agreement demonstrates EXIM's commitment to unleashing US energy molecules and technologies to every corner of the globe," said US EXIM Acting First Vice President and Vice Chairman Jim Burrows. "By financing US technical expertise for Poland's nuclear development, we're supporting American jobs and proving that American innovation leads in the industries of the future."

"The conclusion of the loan agreement is the next stage in PEJ's cooperation with US EXIM, following the previously issued letter of intent for USD17.8 billion, confirming the US agency’s real commitment to the delivery of the project of Poland’s first nuclear power plant," PEJ said. "The current agreement is operational in nature and confirms US EXIM's readiness to continue supporting the project in its subsequent phases."

To date, PEJ has signed letters of intent with 11 export credit agencies from Europe, North America, and Asia, worth more than PLN100 billion (USD28 billion). The financing structure for the nuclear power plant project in the Choczewo commune assumes that debt financing will account for 70% of the investment cost, with the remainder secured with funds from the state budget.

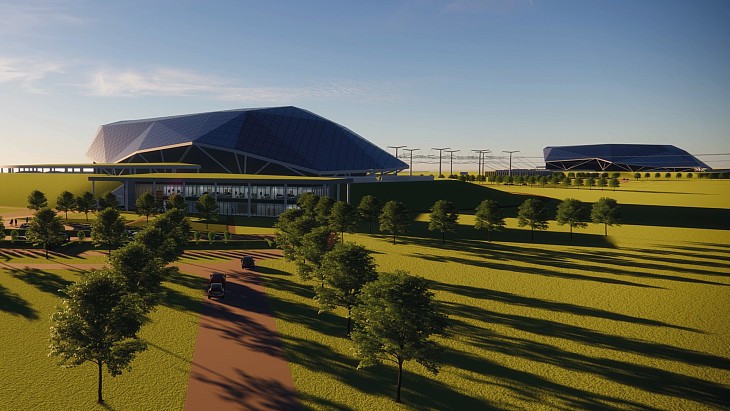

In November 2022, the then Polish government selected Westinghouse AP1000 reactor technology for construction at the Lubiatowo-Kopalino site in the Choczewo municipality in Pomerania in northern Poland. In September 2023, Westinghouse, Bechtel and PEJ - a special-purpose vehicle 100% owned by Poland's State Treasury - signed an 18-month engineering services contract under which Westinghouse and Bechtel will finalise a site-specific design for a plant featuring three AP1000 reactors. In April last year, PEJ and the Westinghouse-Bechtel Consortium agreed the terms and conditions of an Engineering Development Agreement (EDA) after the previous agreement expired.

On 29 December, PEJ announced it had signed an amendment to the EDA with the Westinghouse-Bechtel Consortium. The amended scope of the agreement provides for the continuation of design works covering the nuclear island, turbine island, and the balance of plant, as well as further in-depth geological survey campaigns. This, it said, allows it to maintain the project schedule by advancing the power plant design and continuing field works, while simultaneously conducting negotiations and finalising the Engineering, Procurement, and Construction (EPC) contract, "which will ultimately determine our cooperation with the Westinghouse-Bechtel Consortium".

The Polish government intends to support this investment through: an equity injection of about EUR14 billion covering 30% of the project's costs; state guarantees covering 100% of debt taken by PEJ to finance the investment project; and a two-way contract for difference (CfD) providing revenue stability over the entire lifetime of the power plant of 60 years.

The aim is for Poland's first AP1000 reactor to enter commercial operation in 2033.

_53504.jpg)

_19544_40999.jpg)

_66668.jpg)