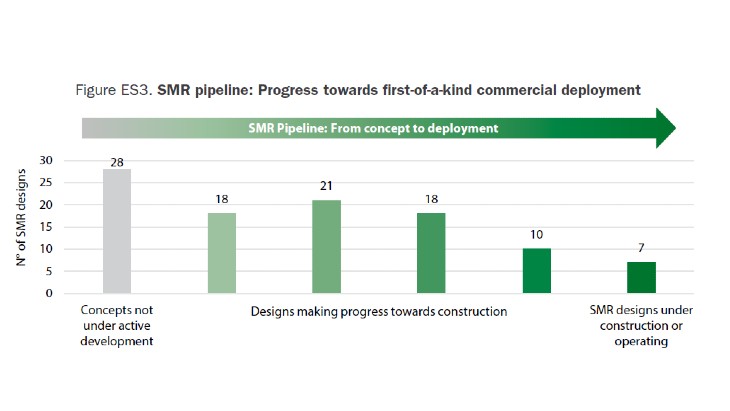

The NEA Small Modular Reactor (SMR) Dashboard identifies 127 SMR designs, which is up from 98 in its previous edition. It also reports that since that 2024 edition there has been an 81% increase in the number of SMR designs to have secured at least one source of funding, or funding commitment.

It says there are seven designs operating or under construction with a "strong pipeline of projects progressing toward first-of-a-kind deployment".

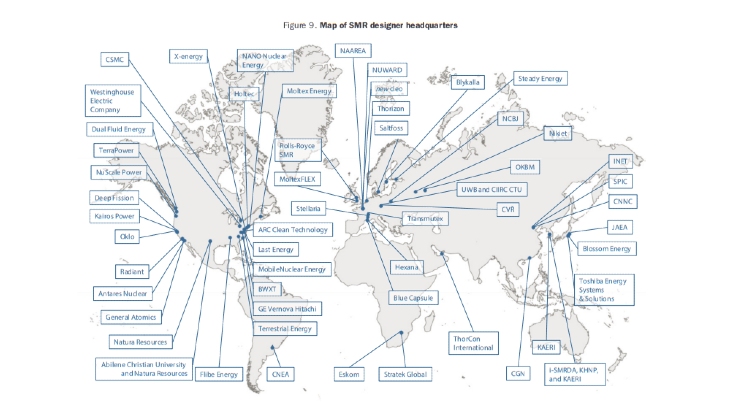

(Image: NEA SMR Dashboard)

NEA Director-General William Magwood, said: "The overarching developments reflected in the NEA SMR Dashboard are clear: the strategic drivers for SMR deployment - rising electricity demand, including from data centres and expanding digital services, energy security imperatives and national goals set by many countries to reduce carbon emissions - are intensifying. SMRs are now a core part of the energy strategies in an increasing number of countries in all parts of the world."

The dashboard is now available as a digital interactive platform, which is searchable by country, by technology and by readiness.

(Image: NEA SMR Dashboard)

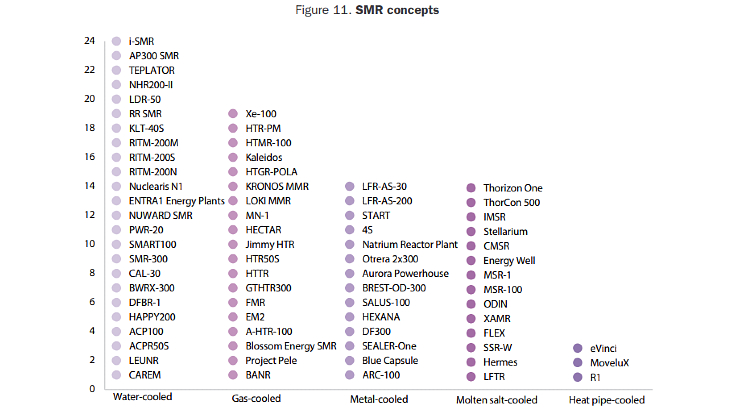

For the new report, 74 of the 127 designs identified were analysed. Of the other 53 designs, 25 asked not to be included in this year's edition, with the other ones including SMR designs not under active development or cancelled or paused.

Favoured fuel

(Image: NEA SMR Dashboard)

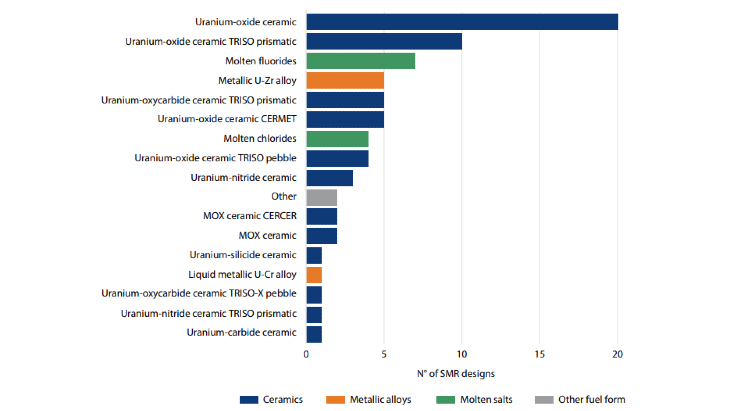

Thirty of the SMR designs reviewed require high-assay low-enriched uranium (HALEU) fuel enriched between 10% and 20% and nine plan to use HALEU fuel enriched between 5% and 10%.

The report notes: "The availability of HALEU remains a significant barrier to the deployment of many SMR designs, though some developers have engaged early to secure supplies for their first-of-a-kind reactors. The data collected shows that as of early 2025, more than half of the SMRs planning to use HALEU had not yet progressed beyond non-binding agreements or collaborative studies with national laboratories related to fuel supply."

It adds: "SMR designs are based on an increasingly diverse range of fuel forms, most of which have not yet been licensed or qualified for use. Uranium oxide ceramics are the most common fuel in commercial reactors today. However, innovative SMR designs are introducing a wide range of novel fuels that require different manufacturing processes and technologies. Standard uranium oxide ceramic fuel is the most common fuel among the SMR technologies under active development, with 39 planning to use it as their fuel. Out of these 39 designs, 19 incorporate or plan to incorporate a composite fuel architecture, such as TRISO, distinguishing them from the conventional fuel used in today’s large-scale light-water reactors and potentially altering significantly fuel fabrication requirements and performance characteristics. More broadly, 47 SMR designs, over 60% of those included in this edition of the Dashboard, rely on fuel forms that are not currently available at commercial scale."

(Image: NEA SMR Dashboard)

Magwood, in his foreword to the third edition of the dashboard, said: "Private investment is surging, with an estimated USD5.4 billion of capital now flowing from venture and corporate sources. Major global corporations such as Google, Amazon, Meta and Dow Chemical have recently bolstered this wave of investment to meet energy needs consistent with their environmental goals. And now with three SMR companies publicly traded, we are witnessing growing confidence in capital markets. The recent announcement that the World Bank will now consider financing nuclear energy projects also sends a clear and powerful signal to other financial institutions.

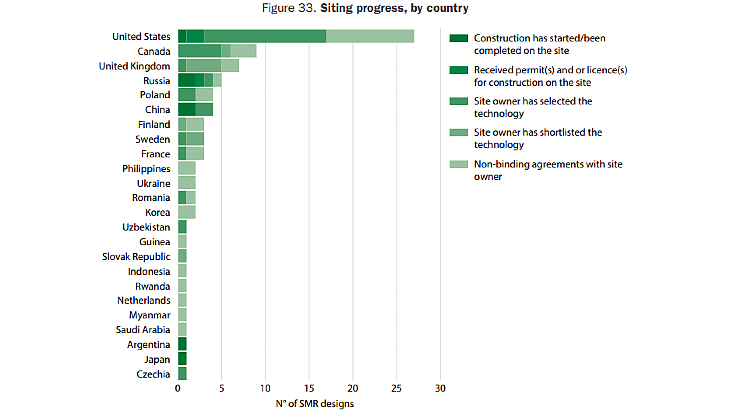

"Equally notable is the evolution on the regulatory front. In 2024, more than 33 SMR designs began pre-licensing activities with nuclear regulators - a 65% increase from the 2023 edition. ... the siting landscape has also evolved, with nearly 85 active discussions worldwide as of early 2025. As SMRs move from concept to construction, new markets are opening - not only for electricity, but also for non-electric applications like industrial heat and hydrogen production. The supply chain associated with SMR sector development is beginning to take shape, with universities, national laboratories and engineering firms contributing to capacity-building efforts."

He added that despite the growth in the sector there were still potential constraints to overcome, such as the supply of HALEU fuel, which "underscores the need for co-ordinated international action and support mechanisms to unlock fuel availability".

The latest edition, which covers the situation up to February 2025, coincides with the digital tracker, which offers "real-time access to global SMR developments. This marks a significant leap forward in transparency, accessibility and utility for the international nuclear policy community".

_730_93825.jpg)

_83147.jpg)

_87299.jpg)