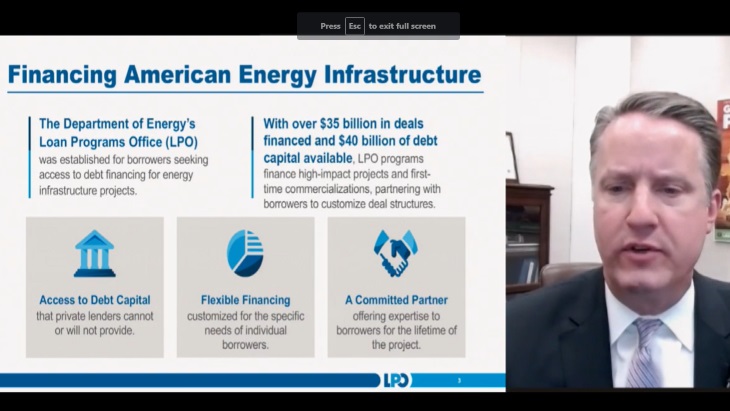

Schultz leads LPO’s lending activities focused on innovative alternative energy projects in the USA, including solar, wind, geothermal, biofuels, clean fossil, nuclear, and the related transmission and extraction infrastructure. The LPO has more than USD40 billion in loans and loan guarantees available to help the deployment of large-scale energy infrastructure projects. Since it began a decade ago, it has closed more than USD30 billion in deals across a variety of energy sectors, providing debt financing for the commercial deployment of large-scale energy projects.

"We are a long-term partner. We have individuals like me with a lot of private sector experience, and some public experience as well because we've got a public mission and we've got to make sure that we work well with our colleagues throughout the government as we're bringing these deals to fruition. But in addition to commercial financial folks like me, we've got a full suite of technologists, engineers, PhDs, and others that are on our teams. Engineers that understand project management as well, so what it's like to have a project under construction, and all the issues that come along with that," Schultz said.

"We've got a full legal team, all of them former partners and transactional attorneys, who bring a broad and long career of experience in private practice. We also have a full environmental team. And then we've got a full portfolio group as well that brings a lot of experience in terms of dealing with troubled assets and not just doing the compliance checks for disbursements, but really dealing with the difficult issues that can occur as we are dispersing a payback for a loan," he added.

Submitting a formal application to the LPO and getting credit approval are very short processes, he said, since they are "very formulaic" in order to provide "continuity and consistency across all applicants". The most important part of the process is in fact engagement between the LPO and a potential applicant before they submit their application, which means "shaping deals to make sure that when an application comes in, it's bankable and ready to go".

"We have a lot of capacity and so we bring a lot to the table when we get involved in deals. Generally we can do the entire amount, but we also like to try and bring in private lenders with us. And we want to engage early so that even before you have an idea for a project, we welcome engagement with what we look at as our prospective borrowers later on.

"That partnership lasts from the beginning, when you're structuring deals, figuring out how to make them bankable, putting our balance sheet behind it so that if we commit something you know that the debt's there, all the way through the lifecycle. It may seem that it's important to do the diligence and get financing early, but there's another part which is that we're a long-term partner; we don’t sell our debt; we stay in the transactions for the life of our loans.

"We're looking to get repaid but we're there to help so we have active portfolio management; we're not passive. So we are probably aware of what's going on before things come up. If we have co-lenders with us, we can be a lead for that group to help organise the other lenders and help them understand what issues are going on. We can jump on things very quickly, or even before they materialise into a significant event and work with our borrowers."

The LPO has USD35 billion deployed on first-of-a-kind projects.

"We did all the first PV solar utility-scale projects, concentrated solar, the new innovations in terms of onshore and offshore wind, energy storage, geothermal, nuclear. We were a large capital provider to Vogtle [nuclear power plant]. We have a lot of investments in the automobile industry as well," he said.

The nuclear sector meets LPO criteria in terms of having innovation and also greenhouse gas avoidance. Projects need to be located in the USA and then, from a debt perspective, offer a reasonable prospect of repayment.

Prior to joining LPO, Schultz was a senior investment officer at the Overseas Private Investment Corporation. In the private sector, he was the manager of project development and finance at KMR Power Corporation, a global independent power company, and was also a principal consultant at K&M Engineering and Consulting.

"As a developer, I wasn't in one of those cushy large corporate environments. I know what it's like to hustle for equity, hustle for debt when no one's giving you anything; I know what it's like to go day to day always wondering where that next dollar is going to come from, and building something from scratch. The nuclear sector is really emblematic of that, where you have a lot of companies bootstrapping themselves and growing. We bring a lot of that mentality in what we do at the LPO. We're not just here as a debt provider; we look at it with a long-term perspective."

_18570.jpg)

_18938.jpg)

_33584.jpg)

_82983.jpg)