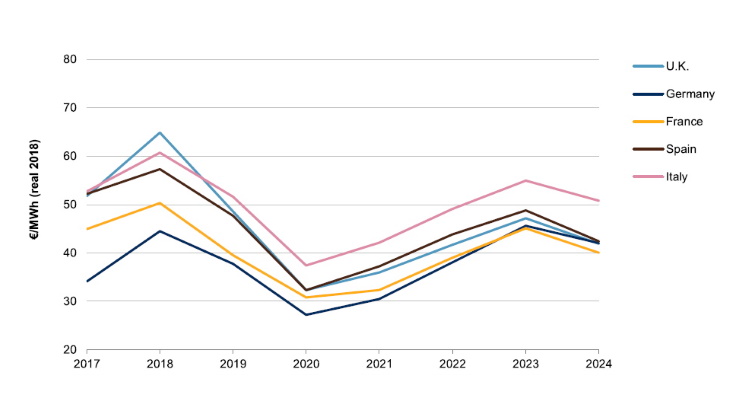

In a report titled The energy transition and what it means for European power prices and producers: Midyear 2020 update, S&P Global Ratings gives its credit insights for Europe's key utilities and power markets - Germany, France, the UK, Italy, Spain, and the Nordics. It says since the start of 2020, European power prices have been impacted by an average 5%-7% drop in demand due to a very mild winter, COVID-19 lockdown measures, increased supply from renewables, and a drop in commodity prices.

The report says the financial impact of the lower prices on its rated European power generators is "generally manageable" in 2020, thanks to price hedges. "However, generators' hedging positions are less secure for 2021, with only about 30%-50% of total power generation contracted on average," it says. "This leaves 50%-70% that still needs to be hedged in an environment of lower prices. While generators still have time to decide on the best approach, the poorer economic prospects and subdued commodity prices do not suggest a strong rebound in power prices in the second half of 2020."

S&P says it therefore may see greater pressure on the 2021 earnings of merchant power generators that provide baseload power, such as nuclear, coal-fired, or hydro power. S&P says prices are only likely to partially recover, with some price increases over 2021-2023, except in the Nordics, as demand rebounds and more coal and nuclear power plants are shut down.

"While we expect prices in 2020-2021 to be lower than our previous forecasts, we expect higher, more credit-supportive prices by 2022," S&P said. "This is because of a recovery in gas and carbon prices, and because Germany will become a net importer of energy, as opposed to an exporter of about 40 terawatt hours (TWh) today. The gap in energy supply is likely to be filled with solar and wind power, which should grow to form about 45% of the European energy mix in 2030, from about 25% in 2019, excluding hydro's 10% share."

S&P Global Ratings expects nuclear capacity in the key European markets to decline by 19% by 2025 compared with levels at the end of 2019. The largest reductions will be in Germany and Belgium, which plan to decommission their nuclear power plants in 2022 and 2025, respectively. In the UK, 4 GWe of nuclear generating capacity will reach the end of its operational life by 2025, but "there are risks of earlier closures than we assume in light of extensive issues at certain plants over the past two years".

French nuclear capacity levels are expected to remain stable, it says, with the 1.8 GWe Fessenheim plant being replaced by 1.6 GWe Flamanville 3 EPR. "However, output will be below historical levels, at least until 2022, in part reflecting heightened flexibility from EDF's fleet," S&P said.

EDF announced in mid-May that it has cut its 2020 nuclear output target for its French fleet to 300 TWh from 375-390 TWh before the COVID-19 pandemic. It has also adjusted its maintenance schedule to reflect operational disruptions caused by the pandemic. The utility is also likely to take some reactors offline to be able to secure supply at the peak of winter. EDF anticipates the sequencing of the reactor outages will only result in a progressive recovery of its nuclear power output to 330-360 TWh for 2021-2022.