UPDATED - This article has been updated with information based on the IEA press briefing in London today (4.15pm 12 November).

The World Nuclear Association (WNA) "shares the concern" of the International Energy Agency (IEA) that urgent action will be needed to steer the world's energy system onto a safer, low-carbon path.

In the 2014 edition of its World Energy Outlook (WEO) issued in London today, the IEA said that nuclear power is one of the few options available at scale to reduce carbon dioxide emissions while providing or displacing other forms of baseload generation. It has avoided the release of an estimated 56 gigatonnes of CO2 since 1971, or almost two years of total global emissions at current rates.

The WEO incorporates all the latest data and developments to produce a comprehensive and authoritative analysis of medium- and longer-term energy trends. The latest edition includes a special focus on nuclear energy.

WNA Director General Agneta Rising said: "The IEA's central scenario would set us on a path of a dangerous increase in global temperatures. We must act to switch to cleaner and more affordable energy sources. Nuclear is a cost-effective way of producing reliable low-carbon electricity on a large scale and must form an increasing part of the world's energy supply if we are to get serious about addressing climate change."

Policies concerning nuclear power will remain an "essential feature" of national energy strategies, even in countries which are committed to phasing out the technology and that must provide for alternatives, the WEO said.

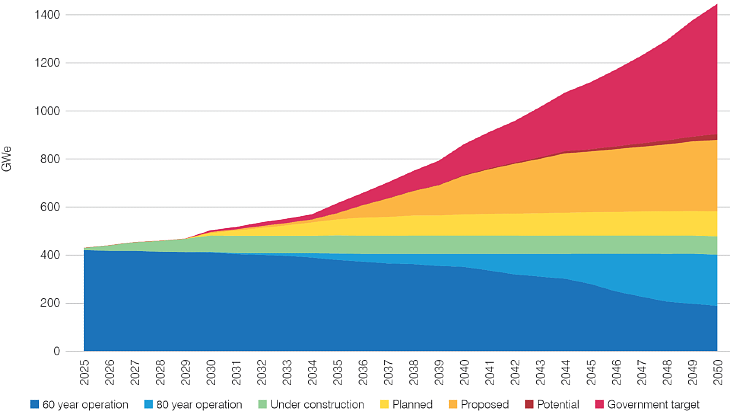

Global nuclear power capacity increases by almost 60% in the IEA's central scenario, from 392 GW in 2013 to over 620 GW in 2040. However, its share of global electricity generation that peaked almost two decades ago, rises by just one percentage point to 12%.

"This pattern of growth reflects the challenges facing all types of new thermal generation capacity in competitive power markets and the specific suite of other economic, technical and political challenges that nuclear power has to overcome," the WEO said.

Growth is concentrated in markets where electricity is supplied at regulated prices, utilities have state backing or governments act to facilitate private investment.

Of the growth in nuclear generation to 2040, China accounts for 45% while India, Korea and Russia collectively make up a further 30%. Generation increases by 16% in the USA, rebounds in Japan (although not to the levels prior to the accident at Fukushima Daiichi) and falls by 10% in the European Union.

"Despite the challenges it currently faces, nuclear power has specific characteristics that underpin the commitment of some countries to maintain it as a future option," it said. "Nuclear plants can contribute to the reliability of the power system where they increase the diversity of power generation technologies in the system. For countries that import energy, it can reduce their dependence on foreign supplies and limit their exposure to fuel price movements in international markets."

In the IEA's 'low nuclear case' – in which global capacity drops by 7% compared with today – indicators of energy security tend to deteriorate in countries that utilise nuclear power. For example, the share of energy demand met from domestic sources is reduced in Japan (by 13 percentage points), Korea (by six) and the European Union (by four) relative to the IEA’s central scenario.

Annual emissions avoided in 2040 due to nuclear power (as a share of projected emissions at that time) reach almost 50% in Korea, 12% in Japan, 10% in the USA, 9% in the European Union and 8% in China. The average cost of avoiding emissions through new nuclear capacity depends on the mix and the costs of the fuels it displaces, and therefore ranges from very low levels to more than $80/tonne.

Almost 200 reactors (of the 434 operational at the end of 2013) are expected to be retired in the period to 2040, with the vast majority in Europe, the USA, Russia and Japan; the challenge to replace the shortfall in generation is "especially acute" in Europe, the WEO said.

"Utilities need to start planning either to develop alternative capacity or to continue operating existing plants years in advance of nuclear plants reaching the end of their current licence periods. To facilitate this process, governments need to provide clarity on their approach to licence extensions and details of the regulatory steps involved well ahead of possible plant closures," it said.

The IEA estimates the cost of decommissioning nuclear plants that are retired in the period to 2040 at more than $100 billion.

Challenges

Fatih Birol, IEA chief economist, said at a press briefing in London to unveil WEO 2014 that, worldwide, there are about 76 GWe of new nuclear power capacity under construction.

"Many countries today say that nuclear power is very important for energy security and an important way of reducing carbon dioxide emissions, but policies are changing. In Europe we see a significant decline in nuclear capacity. This is the result of retirements due to age, but some of them are the result of government policy, such as in Germany and Belgium. In Japan, we expect a rebound, but nuclear will not be a main source of electricity generation there," Birol said.

"In the United States there is about 6 GWe of nuclear capacity under construction, especially in those areas where electricity prices are regulated. There is a strong push in Russia, we don't think as much as the government [target], but we expect an increase there, as well as in India."

The main contribution to nuclear power worldwide is coming from China.

"China is responsible for almost 50% of the growth in nuclear capacity additions. This is mainly the result of China's government policy, the structure of the market and also the fight against environmental issues and energy efficiency concerns. China is developing its own technology and may well compete with many OECD countries in terms of exporting nuclear technology in the years to come. So, China may well appear as a major player in the global energy industry," he said.

Today 80% of nuclear power plants in the world are in OECD countries and around 20% in non-OECD countries. In 2040, that split will be 50-50, he said.

Nuclear power can play an important role for energy security, for climate change and the development of energy systems, but there are some public concerns, "which need to be heard and addressed by governments". Birol highlighted two issues.

"According to current trends, in the next 25 years there will be about 200 reactors that are going to be retired. Decommissioning of those power plants is a major challenge for all of us – for the countries that are pursuing nuclear power policies and for those who want to phase out their nuclear power plants. Worldwide, we do not have much experience and I am afraid we are not well-prepared in terms of policies and funds which are devoted to decommissioning. A major concern for all of us is how we are going to deal with this massive surge in retirements in nuclear power plants," he said.

Another concern is nuclear waste. The amount of used nuclear fuel currently stands at 350,000 tonnes but will increase to 705,000 tonnes in 2040, according to the report.

"We have had nuclear power plants for 60 years, but we don’t yet have a permanent solution to high level nuclear waste. There are some temporary solutions, but how we are going to dispose of high level nuclear waste is a key issue that remains to be addressed," Birol said.

Climate policy

According to IEA estimates, last year CO2 emissions increased by 2.6%, reaching a worldwide record high of 33 gigatonnes. About 60% of those emissions came from China alone. There have been some good developments, Birol said, namely the "very welcome and timely" emissions reduction agreement announced yesterday by China and the USA.

Their joint commitment represents "a giant leap for mankind" for two reasons, he said. Firstly, these two countries are responsible for 45% of global CO2 emissions. Secondly, “on the road to” the United Nations Climate Change Conference in Paris next year, their decision "injects very badly needed political momentum."

"We should not forget that the European Union already made a commitment of reducing its emissions by 40% in 2030. So, if these efforts of the US, China and the European Union materialize and if we see other countries that have not yet committed themselves follow the same pattern, then we may well see that we use our last chance in Paris in the best way possible."

But an enduring concern, he added, is the "huge subsidies" that fossil fuels enjoy worldwide.

"There were about $550 billion in incentives last year to coal, oil and gas consumption, which means I am paying you to pollute the world; I am paying you to use energy in an inefficient way. These fossil fuel subsidies are about four times the subsidies which are given to renewable energies."

"One other piece of good news" is energy efficiency. "We are seeing the impact of energy efficiency policies on numbers and trends. We see a slowing down of, for example, oil demand growth is the result of energy efficiency policies in the transportation sector."

"But is the global energy system going to be driven by the policies governments put together to bring us to a more sustainable future, or is it going to be driven by events?"

There are "three major players" in the global energy picture - the OECD countries, China and the rest of world.

"Between 2000 and today, global energy demand has increased by 30% and about 50% of that growth came from one country, which is China. This put a lot of pressure on many energy and climate issues, but the picture is changing. Energy demand from OECD countries we expect will be more or less flat, mainly driven by efficiency policies pulling it down, the slowing down of the economy and so on," he said.

"The surprise, at least for us, is China. Chinese energy demand growth is slowing down and in the 2020s we think this slowdown will be much more pronounced. There are three reasons why Chinese energy demand will slow down. One, China takes energy efficiency much more seriously than many other countries. Second, economic growth slows down and changes in nature from being energy intensive. And third, population growth in China slows down and then starts to decline."

"China has been the engine of global energy demand in the last decade, but 'the rest of the world' – India and eastern Asia is taking the lead."

In order to have world similar to the one we have today, the climate's temperature should be 2 degrees Celsius, according to the WEO.

"In the last 110 years we have already used 50% of the budget to put CO2 into the atmosphere. If there are no major changes in our policies, we are going to completely consume that budget as of 2040. If we don’t change in terms of energy investments we are soon going to use the budget given to by nature and that will result in a different world," Birol said.

"Emissions in 2040 will be made by the power plants which are built today. Low carbon investments today amount to $400 billion. In our central case it is going to double. In order to see a 2 degrees world, we need more renewables, more efficiency, more nuclear power and more carbon capture and storage." In order to reach this 2 degree "trajectory", low-carbon investment needs to increase four times compared with today.

Paris-based IEA is an autonomous organization which "works to ensure reliable, affordable and clean energy for its 29 member countries and beyond". Founded in response to the 1973-4 oil crisis, the IEA's initial role was to help countries co-ordinate a collective response to major disruptions in oil supply through the release of emergency oil stocks.

Researched and written

by World Nuclear News

_45278.jpg)

_36317.jpg)