Pathways to Commercial Liftoff - announced by last month by US Energy Secretary Jennifer Granholm - aims to provide public and private sector capital allocators with a perspective as to how and when various technologies could reach full-scale commercial adoption. The first Liftoff Reports - designed as "living documents" to be updated as the commercialisation outlook on each technology evolves - on clean hydrogen, advanced nuclear, and long duration energy storage, were published on 21 March.

The reports found that cumulative investments must increase from around USD40 billion to USD300 billion by 2030 across the hydrogen, nuclear, and long duration energy storage sectors, with continued acceleration until 2050, to stay on track to realise long-term decarbonisation targets.

According to DOE, advanced nuclear is widely regarded as a clean, firm power source that can reliably complement widespread renewable energy buildout and is key to reaching US decarbonisation goals, as well as having the potential to create long-term, high-paying jobs and deliver new economic opportunities. However, obstacles identified by the report include increasing the deployment of mature technologies and building efficient and timely delivery models.

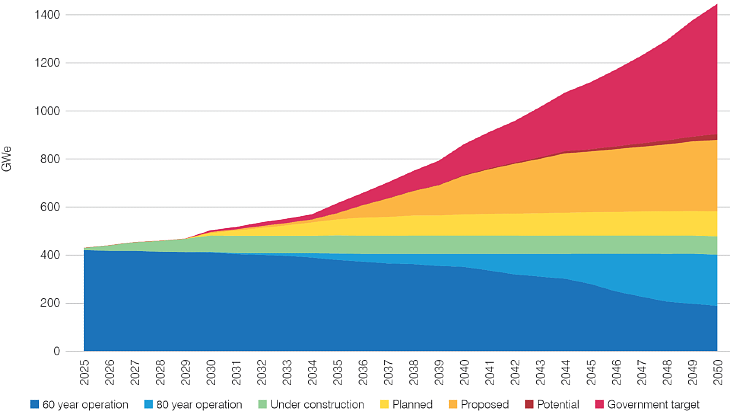

US domestic nuclear capacity has the potential to scale up from around 100 GWe today to around 300 GWe by 2050 - but there is currently a "commercial stalemate between potential customers and investments in the nuclear industrial base needed for deployment", the Advanced Nuclear Liftoff Report notes. "Utilities and other potential customers recognise the need for nuclear power, but perceived risks of uncontrolled cost overrun and project abandonment have limited committed orders for new reactors."

Rapidly scaling the nuclear industrial base would enable nearer-term decarbonisation and increase capital efficiency, it says: if deployment starts by 2030, ramping annual deployment to 13 GW by 2040 would provide 200 GW by 2050. A five-year delay in scaling the industrial base would require an annual deployment of over 20 GW per year to achieve the same 200 GW deployment and could result in as much as a 50% increase in the capital required.

Path to commercialisation

The report suggests a pathway to commercial scale for advanced nuclear in the USA with three overlapping stages of committed orderbook generation, project delivery, and industrialisation. A committed orderbook - for example signed contracts for 5-10 deployments of at least one reactor design by 2025 - will be needed to catalyse commercial liftoff. Once a "critical mass of demand" is established, delivering the first commercial projects reasonably on time and on budget will become the most important challenge As momentum builds, the industrial base, including workforce, supply chain, and licensing, will need to be scaled up.

The buildout would need around USD700 billion or more from private and public sources, but the report also notes that - as of January 2023 - although US customers have indicated their interest in building nuclear through memoranda of understanding or letters of intent, there were as yet no committed orders for new nuclear reactors in the USA.

Reaching 200 GW of new nuclear capacity in the USA by 2050 will require "deliberate action by both the public and private sectors", the report says. Potential solutions suggested in the report include the pooling of private sector demand to spread the risk - for example through the formation of a consortium of companies committing to 5-10 or more reactors, which could help de-risk the initial builds by sharing costs and potential overruns - or the bulk construction of reactors by a developer who then leases reactors or sells the sell the power through a power purchase agreement to end-users.

Insights

According to the DOE, the Liftoff Reports contain insights and takeaways developed through extensive stakeholder engagement, system-level modelling and project-level financial modelling and are intended are a resource intended to inform decision making across industry, investors, and the broader stakeholder community, but do not reflect DOE official policy or strategic plans.

"As we combat the climate crisis and race towards an equitable clean energy future, public and private partnerships will be more important and critical than ever before," Granholm said. "The Liftoff reports will help drive engagement between government and industry to unlock exciting new opportunities and ensure America is the global leader in the next generation of clean energy technologies."

.jpg)

_19544_40999.jpg)

_66668.jpg)