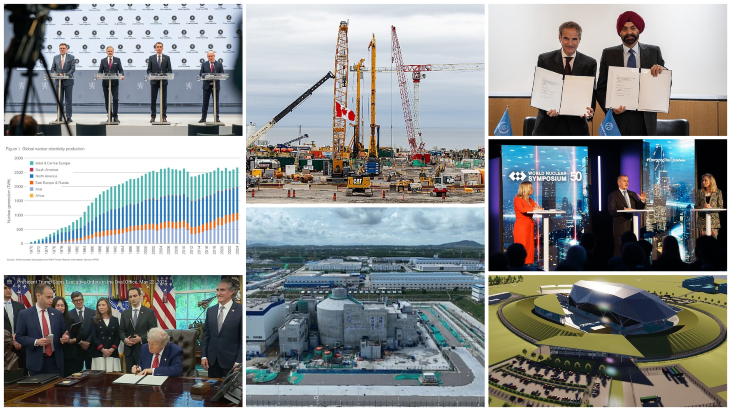

World nuclear generating capacity is set to continue to grow according to the World Nuclear Association's newly published biennial report on the nuclear fuel market. Projections of installed capacity - and the uranium required to fuel it - have been revised downwards since the 2015 edition but still represent a higher growth rate than any seen since 1990.

The Nuclear Fuel Report: Global Scenarios for Demand and Supply Availability 2017-2035, was launched today in London at the World Nuclear Association's annual Symposium. The report uses publicly available information and information gathered from utilities and suppliers - both members and non-members of the association - through questionnaires.

The World Nuclear Association working group responsible for drafting the report was co-chaired by Fletcher Newton, president of Tenam Corporation, and Fredrik Leijonhufvud, purchasing manager at Vattenfall AB. Newton said the report had been prepared to be "genuinely reflective" of the current state of the industry "without any unnecessary glossing over of difficulties or understatement of the challenges" facing it.

The report outlines Upper, Reference, and Lower scenarios with underlying generic assumptions concerning the economics of nuclear power, public acceptance, greenhouse gas abatement measures and electricity market structure.

Global nuclear capacity continues to grow over the period to 2035 under both the Upper and Reference scenarios, with installed capacity increasing by 70% and 35% respectively - both higher than growth rates seen over the past 20 years. Capacity declines slightly under the Lower scenario. Growth is dominated by increased capacity in China, increasing from 37 GWe today to 141 GWe in 2035 under the Reference scenario.

The projections of installed capacity are lower than those in the previous edition of the report, published in 2015, by about 15% for the Upper scenario and 10% for the Reference scenario. Further closures for economic reasons and less new construction than previously anticipated in the USA, delays to some Chinese construction projects, changes to South Korean plans, and slower restarts of Japanese reactors are among the considerations contributing to the decline.

Nuclear is today facing challenges, Leijonhufvud said. These include lower expectations of electricity demand growth, increased competition from gas and renewables, electricity market liberalisation, political opposition, and difficulties encountered in some Generation III reactor construction programs, he said.

Reserve projects to meet supply gap

World reactor requirements for uranium, estimated at about 65,000 tU in 2017 are expected under the Reference scenario to rise to 75,000 tU in 2025 and 94,000 tU in 2035. In the Upper Scenario, uranium requirements are expected to be 84,000 tU in 2025, and 122,000 tU in 2035. These figures are down from those in the 2015 Fuel Report, and Newton said the latest projections were based on more precise numbers and rigorous analysis.

World uranium production rose to 62,221 tU in 2016, and according to the report, known global resources of uranium are more than adequate to satisfy reactor requirements to well beyond 2035. Currently depressed uranium prices have curtailed exploration activities and the opening of new mines, and the number and size of new mines that are under development, planned or prospective have fallen significantly compared with the 2015 report.

Demand for uranium is met from both primary and secondary sources of supply, including commercial and government-held inventories, downblended highly enriched uranium, recycling of material from reprocessing of used fuel, re-enrichment of depleted uranium stockpiles, and over- and under-feeding of enrichment capacity.

Although uranium is currently in a situation of oversupply, the Reference scenario sees a gap between projected demand opening up after 2023, with larger supply gap under the Upper scenario. The Lower scenario also sees a small supply gap opening later in the projection period. These gaps would need to be met from 'reserve projects': a range of possible projects some of which could be developed within five years.

Fuel cycle

Conversion and enrichment capacity should be sufficient to meet Reference scenario demand until 2030, but Newton said the segmented nature of the markets, with production centred on a limited number of plants, presented a challenge. "If either one of those [conversion] facilities were to go down, even though the conversion markets are on aggregate oversupplied, it would have a tremendous impact," he said. The enrichment market faced similar potential challenges, he added.

A similar pattern is seen for demand for fuel fabrication services, Leijonhufvud said. Current capacity is more than sufficient to meet demand but the market is highly segmented and bottlenecks for particular fuel designs could occur.

Call to action

Speaking ahead of the publication of the report, World Nuclear Association chairman Agneta Rising said the projections suggest that unless action is taken, the pace of growth in nuclear generation will slow. "The nuclear industry has set a goal to supply 25% of the world’s electricity by 2050, which will means the construction of 1000 GW of new nuclear capacity. This expansion of nuclear capacity is achievable, requiring new nuclear build at rates the industry achieved in the 1980s. But even our upper scenario would not be enough to meet this climate goal. Nuclear needs to do more," she said.

Researched and written

by World Nuclear News

_47120.jpg)

_23621.jpg)

_63865.jpg)